When ChatGPT surged to 800 million monthly active users globally, its "electricity bill" also quietly expanded to an alarming scale. HSBC's latest calculation released on November 24 shocked the capital market: to survive until 2030, OpenAI would need another $207 billion (about 1.47 trillion Chinese yuan) to buy computing power, equivalent to building another "medium-sized state" power plant in the U.S. Midwest. More awkwardly, even if revenue breaks through $213 billion by then, the company might still not make a single penny of profit — free cash flow remains persistently negative, with the gap being that $207 billion above.

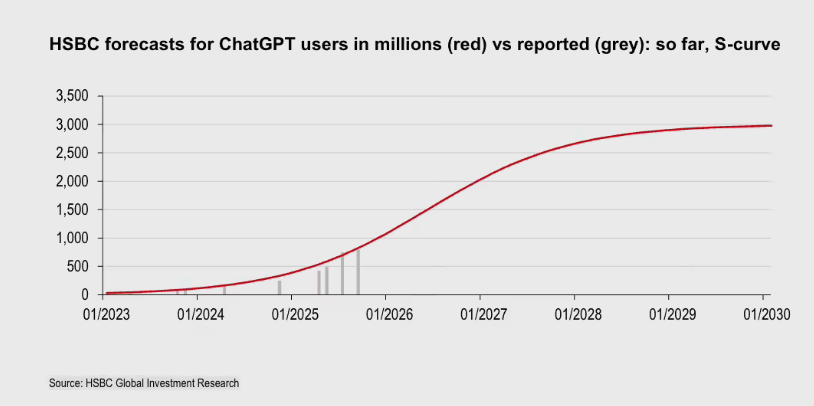

The conclusion that "revenue surges ≠ profit" became the most glaring in the report. According to HSBC's model, by 2030, OpenAI will have 3 billion users, covering 44% of the world's adults, with the paid ratio doubling to 10%, and capturing 2% of the digital advertising market. However, the cloud rental agreements signed with Microsoft and Amazon, totaling $250 billion plus $38 billion, will push the cumulative data center rent to $792 billion; the rent bill alone for 2030 will be as high as $620 billion, almost devouring all revenue. In other words, every time ChatGPT answers "hello," the back-end adds a "liability" to the ledger.

The capital market has already priced in this "bottomless pit" consumption: Oracle and Meta recently issued a lot of bonds for AI expansion, credit default swaps have soared, and investors are using their wallets to express doubts about the sustainability of AI financing. If OpenAI follows suit and takes on debt, it will face liquidity stress; if it slows down investment, it may be overtaken by competitors — the consumer market share is expected to drop from 71% to 56%, while enterprise market share will fall from 50% to 37% during the same period. HSBC bluntly stated that the company will have to rely on continuous rounds of financing to "stay alive" for the next decade. Once risk appetite cools down, the bubble expectations of the entire AI industry could be burst instantly.

The Solow Paradox has also been brought back to the table: AI is everywhere, yet it is nowhere to be found in productivity statistics. As OpenAI's computing power demand approaches 36GW and annual losses hit new highs, the market is increasingly worried — will this cycle of "investing heavily in computing power → models become smarter → monetization remains uncertain" reach a profit turning point first, or will a capital cold wave come first? In HSBC's calculation, the answer remains undecided, but the alarm of $207 billion has already been sounded.